Last month, I attended the New York launch of the United Nations High-Level Panel on Women’s Economic Empowerment, a multi-sector panel of senior leaders and influencers formed last year to accelerate progress on women’s empowerment. The panel presented its first report to Ban Ki-moon, who proudly declared himself the first feminist Secretary-General of the UN.

What struck me the most about the plenary remarks by leaders and influencers, such as International Monetary Fund Managing Director Christine Lagarde, IKEA Switzerland CEO Simona Scarpaleggia, and World Bank President Jim Yong Kim, is their shared belief that financial inclusion is fundamental to empowering women. Virtually every speaker, including Ban Ki-moon himself, called for closing the access-to-finance gap for the world’s poor and particularly for women, who remain disproportionately unbanked.

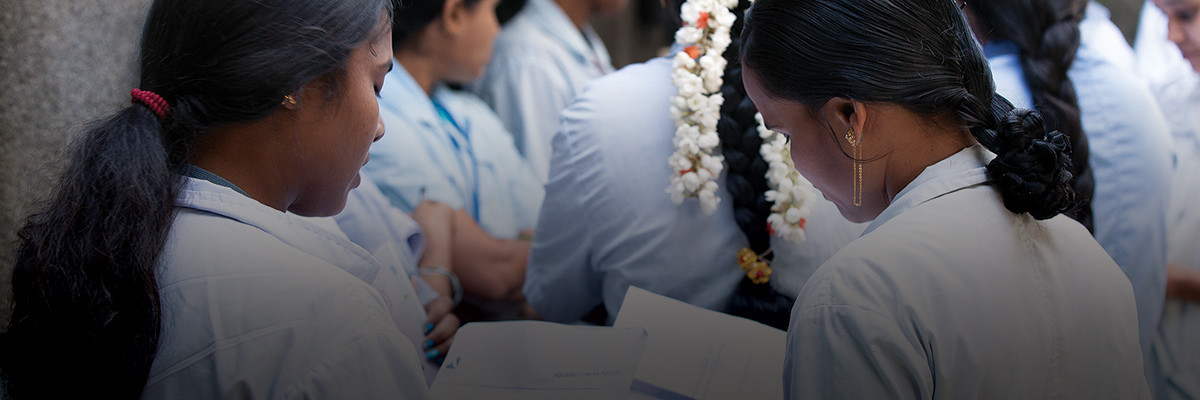

We have been working for the past four years to increase financial inclusion for low-income women as part of BSR’s women’s empowerment efforts. We launched our HERfinance program in 2012, and have since provided financial-literacy training to more than 50,000 low-income adults. In 2015, we formed a partnership with the Bill & Melinda Gates Foundation to integrate digital payroll into the HERfinance program, supporting women working in factories in South Asia to receive their wages via a mobile phone, instead of in cash. This effort has the potential to bring millions of unbanked women into the formal financial system for the first time, while also reducing the risks they face in handling cash on a monthly basis.

While we have been successful in signing up several global brands—including Fast Retailing, Lindex, and Target—to support our work within their supply chains and will be helping more than 30,000 low-income workers, mostly women, get banked this year, we still hear skepticism from companies who doubt the impact of financial inclusion on a woman’s well-being, compared to critical issues like health and gender-based violence.

It is true that “financial inclusion” is not explicitly one of the Sustainable Development Goals (SDGs). However, a closer review of the 17 goals proves its importance to sustainable development: A formal bank account is a means to an end and not the end goal itself. At BSR, we believe financial inclusion is an enabler of women’s empowerment, and that’s why it is an important part of the HERproject alongside our efforts on improving women’s health (HERhealth) and gender relations (HERrespect).

Indeed, several of the SDGs explicitly make reference to increasing access to finance, and a functioning and equitable financial system is key to achieving the SDGs. Take five of the goals:

- SDG 1: No Poverty. Research shows that people climb in and out of poverty throughout their lives. A bank account helps economically vulnerable people save for emergencies and weather economic shocks, such as loss of employment or illness, helping break the poverty cycle. Therefore, this goal calls for all men and women to have equal access to financial services by 2030.

- SDG 2: Zero Hunger. To meet growing food supply needs, we must double agricultural productivity. Access to financial services, such as credit and agriculture insurance, offer small-scale food producers, many of whom are women, the ability to invest in their agriculture businesses in ways that could increase yields.

- SDG 3: Good Health and Well-Being and SDG 4: Quality Education. When women make spending decisions, more household resources are put toward health and education, creating a virtuous cycle for the entire family. Financial services, such as medical insurance and student loans, can also support these development objectives by enabling people to get the preventive care they need, or to pay for school tuition fees.

- SDG 5: Gender Equality. When women have equal rights and access to economic resources, such as financial services, they tend to have greater control over their finances. This control elevates their position in the household, tackles gender-based stereotypes, and reduces women’s dependence on men for their livelihoods.

It’s also important to note that financial inclusion is broadly believed to support more inclusive, broad-based economic growth, as the World Bank has found. Women make up half of all entrepreneurs and the majority of the labor force in industries critical to economic growth across the developing world. Yet, women lack equal access to financial resources that support their full economic participation and success.

The High-Level Panel report was an important milestone that brought together leaders from all sectors to encourage action on economically empowering women. At BSR, we too are calling for more companies—such as buyers who source from across the developing world and employers of large numbers of low-income women—to join us in our efforts. With your partnership, we can help bring millions of women into the formal financial system. This is essential to supporting women’s improved health, autonomy, and economic status; continuing business and economic benefits; and achieving our shared sustainable development agenda.

Let’s talk about how BSR can help you to transform your business and achieve your sustainability goals.